The ESRs which became effective on 1 July 2019 and are applicable to basis periods beginning on or after 1 July 2019 and subsequent basis periods the interest expense deduction is restricted to a maximum amount of interest as determined under the ESRs. Income Tax Restriction on Deductibility of Interest Rules 2019 which is also known as earning stripping rules ESR has been gazetted on 28 June 2019.

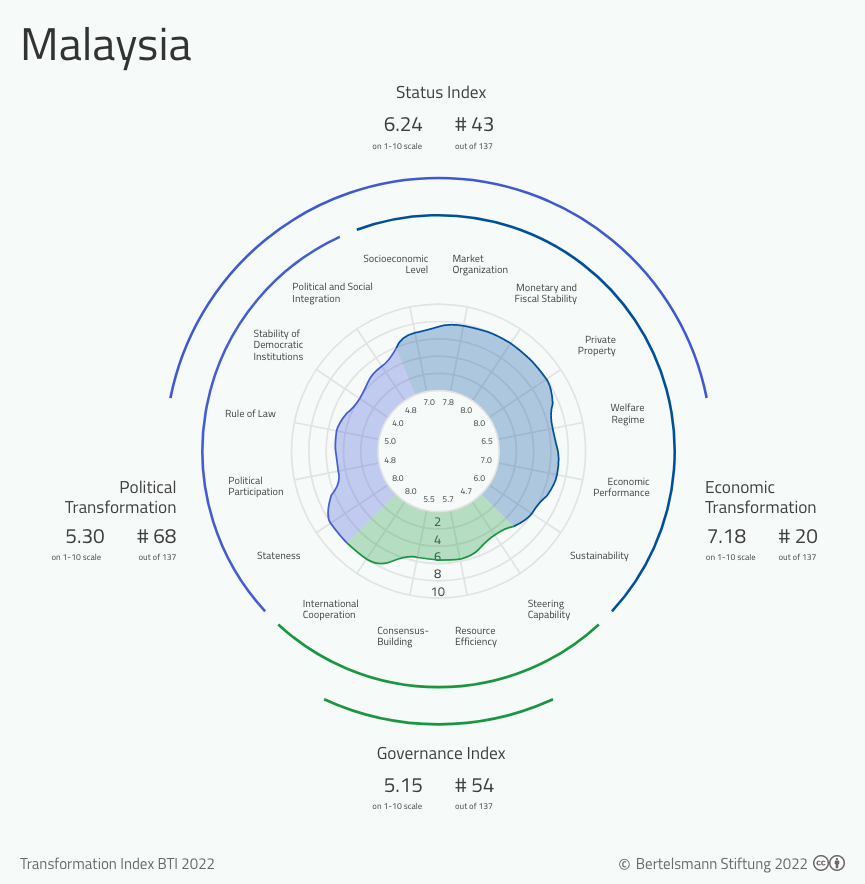

Bti 2022 Malaysia Country Report Bti 2022

Finance act 2018 had introduced a new section 140c to the income tax act 1967 ita to restrict the deductibility of interest expenses.

. This legislation on interest restriction is based on The Base Erosion and Profit Shifting BEPS Action 4 of the Organisation for Economic Cooperation and Development OECD where the aim is to prevent base erosion through the use of excessive interest expense or any payments which are economically equivalent to interest claimed by businesses. Interest on all forms of debt. Section 140C This is an ESR earnings stripping rules which implement the restriction on deductibility of interest for the following types of interest expense.

As prescribed under section 331a of the act the adjusted income of a person from a. 7 February 2011 CONTENTS Page 1. Carryforward of interest expense Where a company has interest expense in excess of 20 of Tax-EBITDA the excess can be carried forward and deducted against the adjusted income of the company for subsequent YAs.

Tax treatment of interest expense 1 - 3 6. Similar restrictions are called Thin Capitalisation Rules in some countries. INTEREST RESTRICTION INLAND REVENUE BOARD MALAYSIA Public Ruling No.

The bumiputra lot quota regulations under the Malaysia New Economic Policy NEP in the 1970s was introduced as a measure to increase bumiputra shares in real estate through. We provide you a general overview of the new Earnings Stripping Rules which came into operation on 1 July 2019. Restriction on deductibility of interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction on Deductibility of Interest Rules 2019 has been introduced to restrict deductions for interest expenses or any other payments which are economically equivalent to interest to ensure that such expenses commensurate with the business income.

The Inland Revenue Board of Malaysia IRBM has published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 which amends the original rules published in 2019This includes amendments to the definition of qualifying deduction which is included in the formula for ascertaining tax-EBITDA. Holds a 35 stake in ABC Sdn Bhd and also owns 65 equity capital in XYZ Co. Will be subjected to interest restriction under Section 140C of the Act.

22011 Date of Issue. Interest restriction under subsection 332 of the ITA 3 - 7 7. Gains or profits in lieu of interest 1 3.

The Income Tax Restriction on Deductibility of Interest Rules 2019 Rules has recently been gazetted and came into operation on 1 July 2019. Has ordered ABC Sdn Bhd to. Tax treatment of interest expense 1 - 3 6.

Recently the inland revenue board of malaysia irbm issued the restriction on. Related provisions 1 4. For more information on local rules and restrictions visit MyGovernment Malaysia Government Portal.

Purpose of these rules As the name suggests these rules are to address the tax planning trick by which profit is being shifted. Or payments which are economically. Interest The Rules and Guidelines provide that the maximum amount of deductible interest is 20 of the amount of Tax-EBITDA.

Recently the Inland Revenue Board of Malaysia IRBM issued the Restriction on Deductibility of Interest Rules ESR which are intended to prevent base erosion through the use of excessive interest expense or any payments which are economically equivalent to interest via controlled financial assistance. Application requirements of the new rules Generally the rules shall apply. Owns 25 shares of ABC Sdn Bhd owns 25 shares of ABC Sdn Bhd ii.

Section 140C is a new section in Malaysian Income Tax Act 1967 ITA introduced via Finance Act 2018 effective from 1 July 2019. Subsequently on 5 July 2019 the Inland Revenue Board of Malaysia IRBM published the guidelines for restriction on deductibility of interest against business income ie. Guidelines for Restriction on Deductibility of Interest under Section 140C Introduction Further to the release of Income Tax Restriction on Deductibility of Interest Rules 2019 the ESR Rules as reported in our Special Alert 2 July 2019 the Inland.

Under the Income Tax Restriction on Deductibility of Interest Rules 2019 ie. On 24 June 2019 the Malaysian government has issued the Income Tax Restriction on Deductibility of Interest Rules 2019 ESR Rules for the purpose of implementing the earning stripping rules. Any payment of interest by ABC Sdn Bhd to ABC Co.

Legal News Analysis - Asia Pacific - Malaysia - Tax Malaysia - Section 140C Of The Income Tax Act 1967 And The Income Tax Restriction On Deductibility Of Interest Rules 2019. Generally a restriction on deductibility of interest should prevent an excessive debt financing and the possibility of income shifting through it. Inland revenue board of malaysia.

Consequently there is now a maximum cap on the allowable deduction on interest expense for a. Subsection 33 2 interest restriction will be computed based on the end-of-year balance the total cost of investments and loans which are financed directly or indirectly from the borrowed money does not exceed RM500000 subsection 33 2 interest restriction will be applied strictly based on monthly balances.

Malaysia Special Tax Concessions For Individuals Kpmg Global

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Refinancing And The Taxation Of Interest Some Common Questions Crowe Uk

Pdf Balancing Freedom Of Speech And National Security In Malaysia

Uniform Global National Interest Exceptions To Covid 19 Travel Restrictions United States Department Of State

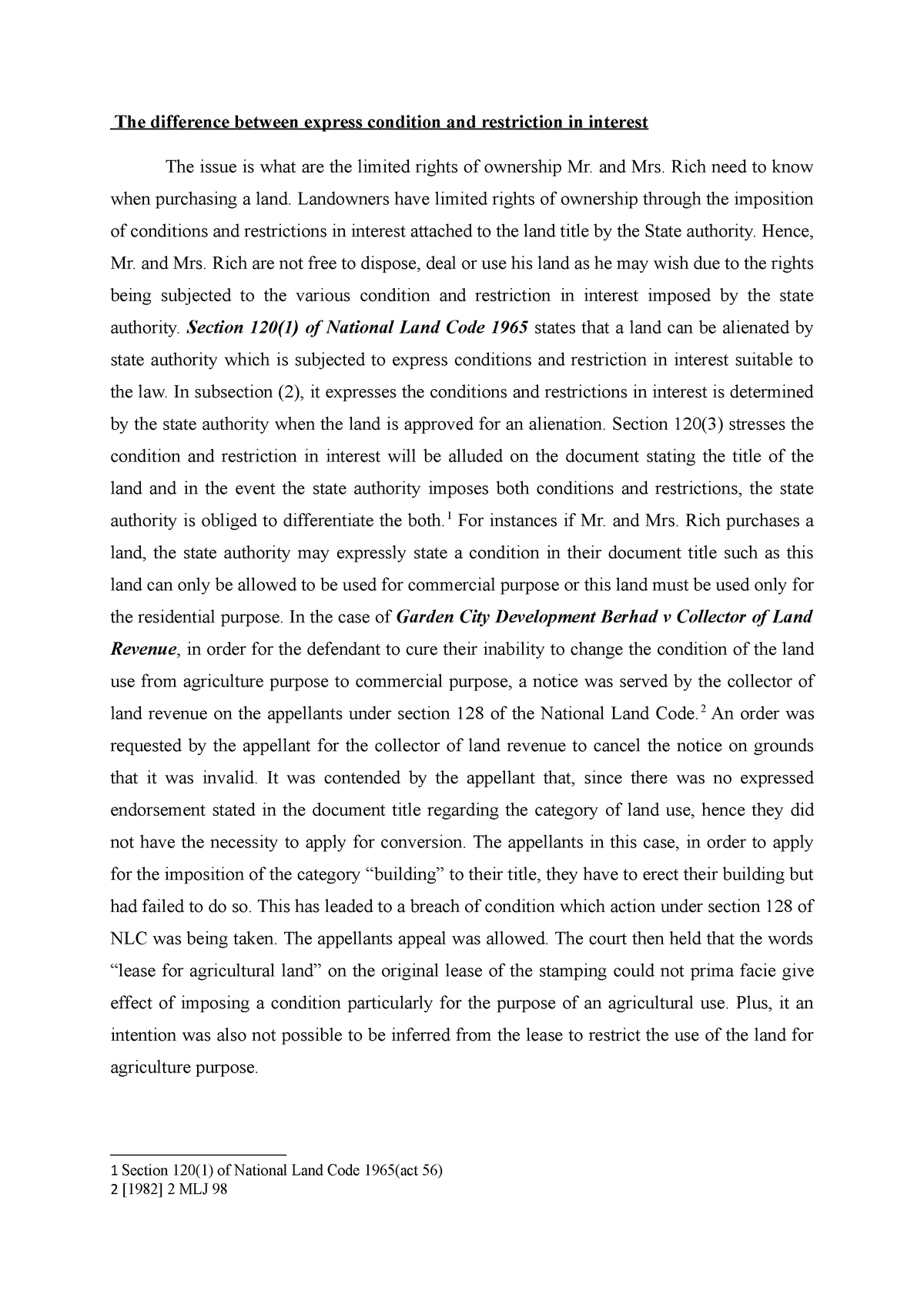

Conditions And Restriction And Mrs Rich Need To Know When Purchasing A Land Landowners Have Studocu

Unlawful Assembly Law In Malaysia In Regards Of Peaceful Assembly Act

Us Lifting Covid 19 Travel Restrictions Kpmg Global